Going Solar In Texas

Many folks have begun tossing around the idea of the monetary benefits of going solar in Texas. However, a good chunk of them never get past the contemplation stage. It can feel overwhelming. So, many wonder if it’s worth the transitional work in the long haul.

Benefits of Living in Texas

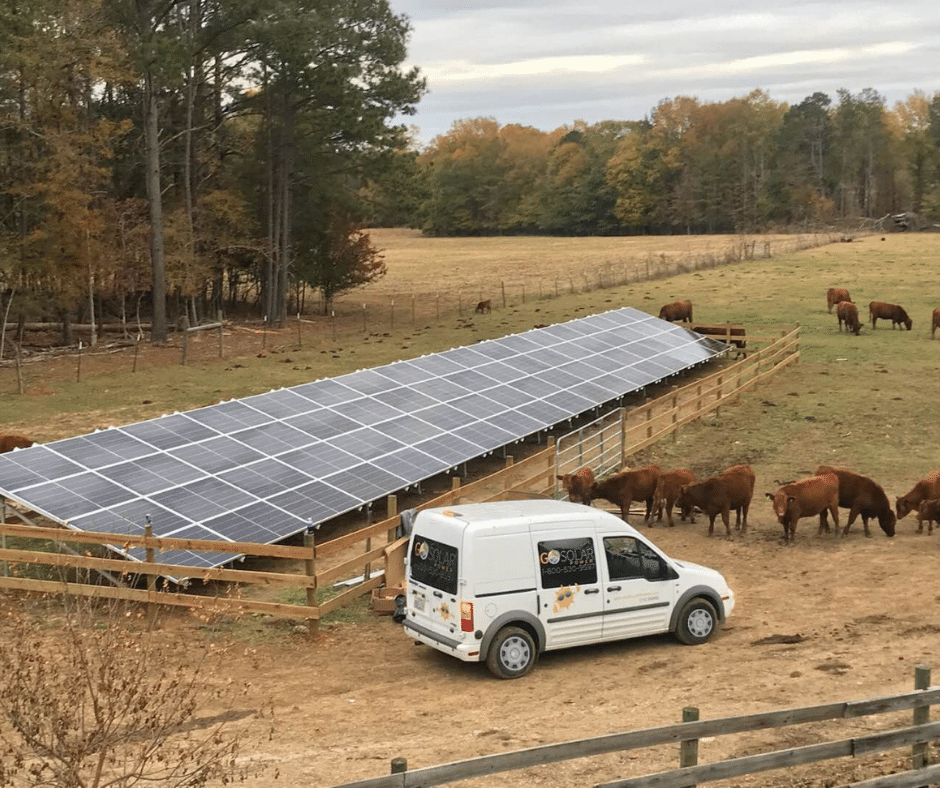

For residents of Texas, tax credits and rebates have made going solar easier. More importantly, cheaper than ever. Especially with help from Go Solar Power.

Read on to learn more about the tax benefits and rebates. In addition to other factors that make solar panels an excellent choice for your home or business.

One of the Best States for Solar

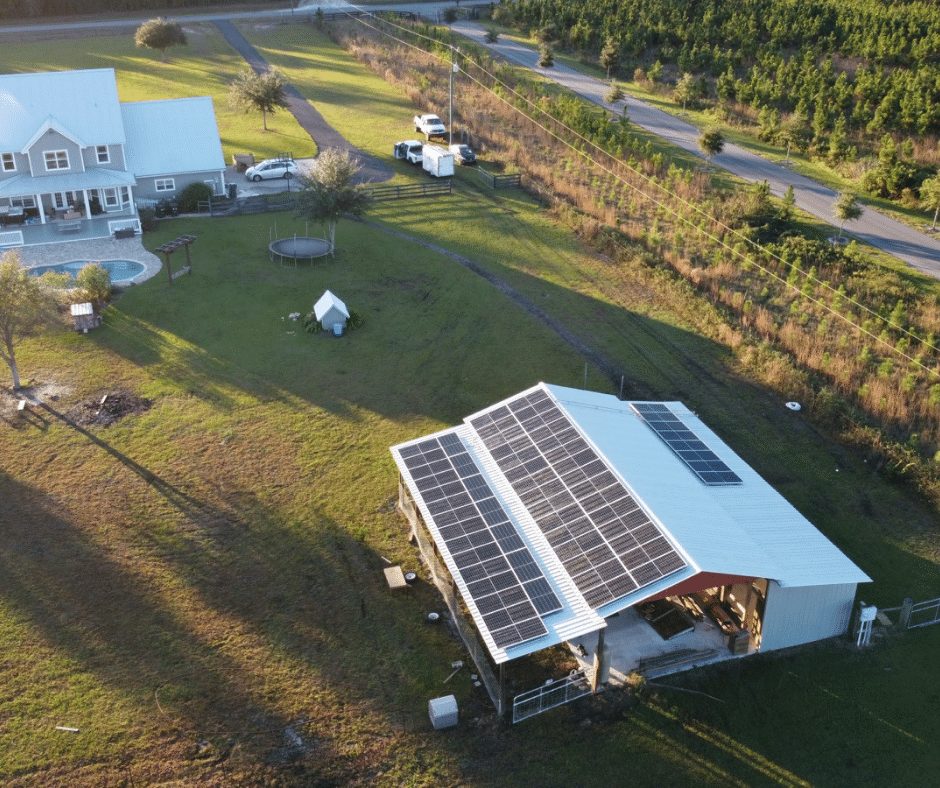

Texas is one of the best states in America to use solar panels. Aside from Texas’s abundant sunshine, it’s now home to many rebates for homeowners. Businesses can also install and utilize solar power and batteries.

These incentives can not only help with the cost of purchasing and installing solar energy systems. It can also save you significant amounts of money on your electric bills each month.

Investigate Going Solar In Texas

To find these programs, you may have to do a little digging. Texas doesn’t have a formal state tax credit for solar energy. However, many utility companies and local government agencies do provide rebates and incentives to those who use solar panels.

For Example…

For example, residents of Austin that use Austin Energy can receive a rebate of $2,500. Just for taking a course and purchasing qualifying solar panels. The City of San Marcos, on the other hand, offers up to $1.00 per watt up to $2,500 for families and $5,000 for commercial operations.

Check with your local utility companies and government agencies. See what kind of breaks, rebates, or incentives may be available to solar panel users.

The value of these incentives can change or drop quickly. Especially as more families and businesses begin to use solar panels. It’s in your best interest to invest as soon as possible.

Net Metering Credits for Going Solar in Texas

Many utility companies have programs that provide credits to solar panel users. Especially when their system generates extra electricity.

These credits offset periods of time when the solar panels cannot meet your household’s needs. Specifically nighttime or cloudy days.

Check with your local electric company. See if they provide net metering credits to households and businesses with solar panels.

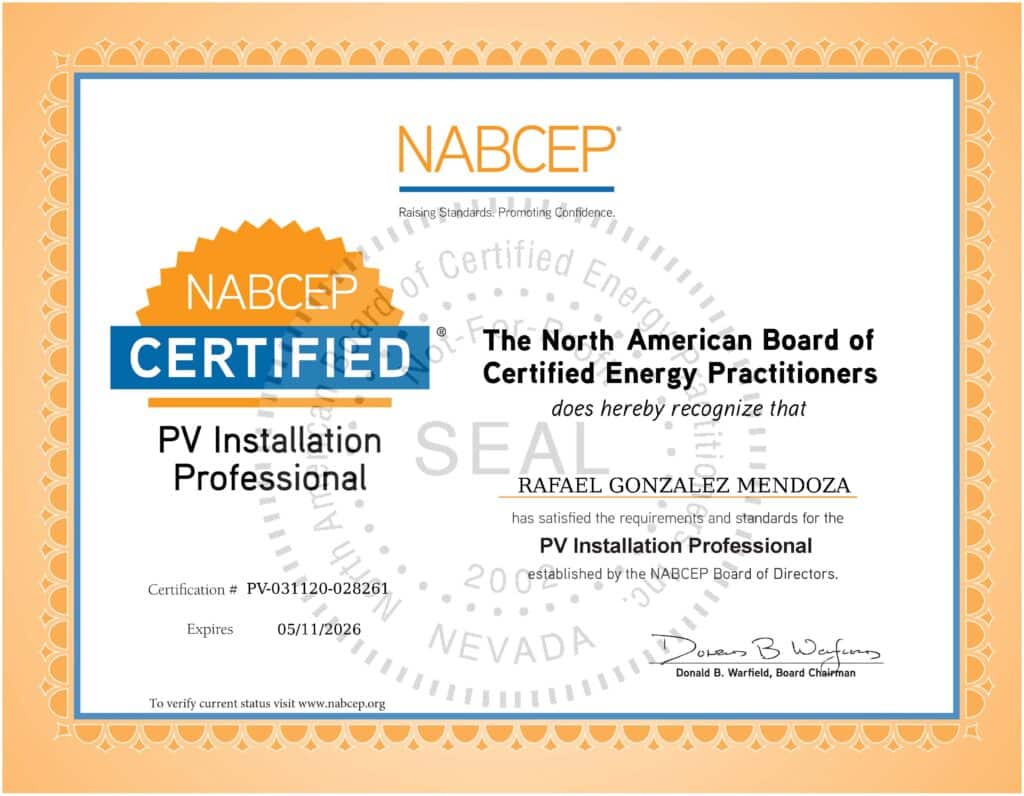

Contact Us

If you’re ready to get started on your solar panel project, please contact us today. We are passionate about helping families and businesses. To lead a more sustainable and energy efficient way of life and more importantly save you money.