One of the biggest questions newcomers have when entering the solar panel field is what the ROI looks like after the installation is complete. Return on investment (ROI) is certainly important with any big investment, and solar is known as a long-term investment that pays off over an extended period of time.

However, that doesn’t mean your options for earning money back aren’t diverse and accommodating. As you’ll learn below, there are many ways you can potentially earn money back at different rates. Not only can homeowners benefit from solar incentives, but so can the many businesses that install panels at their office. Let’s go through the primary solar panel rebates and incentives for your business. Then, you can start planning your project and calculating your ROI with ease.

Federal ITC

One of the most well-known solar incentives is the federal solar investment tax credit (ITC.) This tax credit is so well-known because it’s a great way for homeowners to recoup the costs of the project over time, but businesses can use this credit, too. Of course, having solar panels doesn’t automatically mean you’re eligible for the ITC, so be sure to follow the standards carefully. For instance, it’s essential for your system to feature photovoltaic panels if you want to be eligible, though that’s only one factor to consider.

Don’t worry; that might sound very specific, but PV solar panels are the most prevalent options available. Plus, depending on the timeline of your panel installation, the ITC may cover anywhere between 10 to 30 percent of the installation. As you can see, there are effective ways you can start achieving a solid return on investment with your solar system, though the systems are designed to achieve both short-term and long-term benefits, from the ROI to the uninterrupted power. However, as you’ll learn below, the federal ATC isn’t the only incentive available.

MACRS

Thanks to the many benefits and rebates available, you can find options that deliver an ROI in different ways. Solar might seem like a niche to some newcomers, but it’s a broad, diverse field. Not only do solar systems come in many forms, but so do the potential incentives. For example, MACRS is a way for you to earn money back quicker up front and less in the long run, which is preferrable for some home and business owners. MACRS represents the modified accelerated cost recovery system.

Unlike the ITC, MACRS is not a tax credit; it is a deduction. MACRS is a depreciation system that allows owners of solar panels to earn their ROI in higher numbers earlier after the installation than they might otherwise. This accelerated return method is another common benefit of installing solar panels for your business, but don’t forget that other benefits at the state level exist, too.

State Incentives

The ITC exists on a federal level, but some solar incentives differ by each state, offering more unique ways for people to earn their ROI. Thus, one of the best ways to learn about potential benefits is by looking at a comprehensive overview of incentives by state. For instance, you’ll notice that Florida has an extensive list of rebates, such as the New Smyrna Beach Commercial Energy Efficiency Rebate Program.

Likewise, one of Texas’ many incentives is the Solar and Wind Energy Business Franchise Tax Exemption for local companies. Solar panel benefits like these are all over the country, so do a deep dive into your local incentives and rebates to learn how they can help you out before or after installing solar panels.

Although learning the many options available requires time, it’s well worth the effort if you want to see just how diverse your rebate options are today. If the upfront cost of solar systems is an issue for you, explore the rebates and incentives available to see if you can achieve a more optimal ROI for your project. After all, commercial solar panels can deliver many more benefits when the project is complete.

Solar Benefits for Businesses

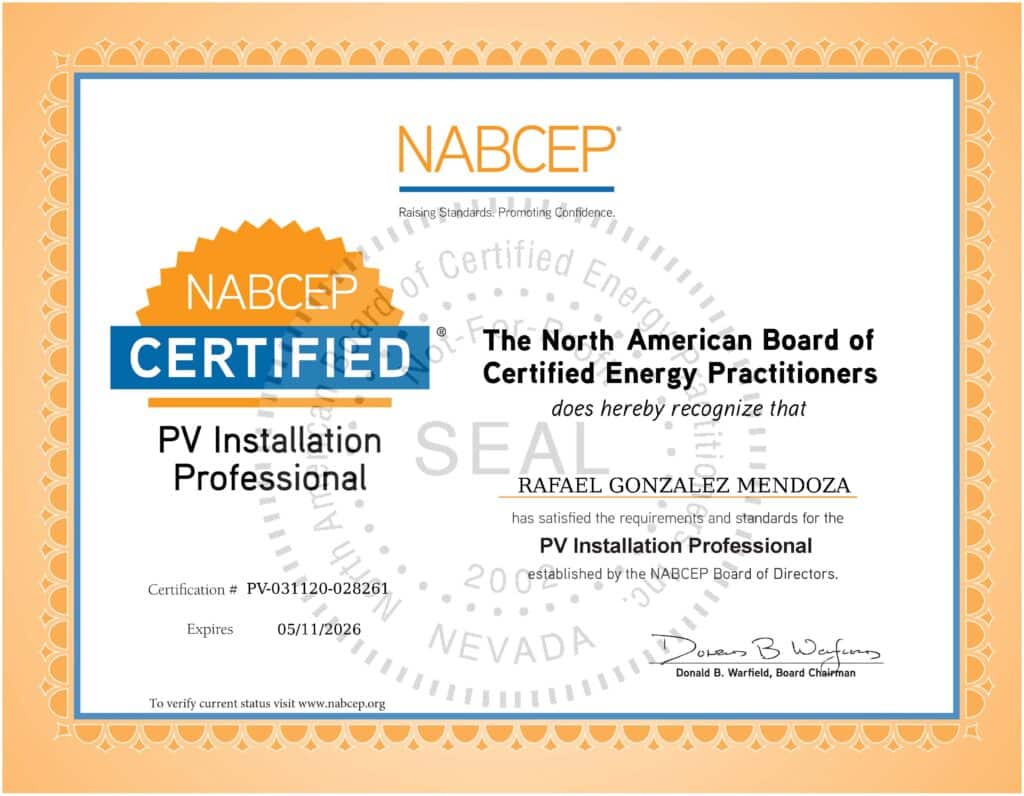

Now that you’re more familiar with the many solar incentives, you can start planning your installation accordingly. Suffice it to say that careful planning is key for installing solar panels, but that will be straightforward with the right professionals by your side. Not only do you need to know the incentive you want to achieve, but you also need an installation team who can help you achieve specific designs. Following precise steps will help you successfully qualify for the various rebates and beyond, so be sure you’re working with trained professionals.

For instance, our team at Go Solar Power can install residential systems, but we’re also experienced commercial solar system installers. Working with professionals means you can benefit from their experience and the fine-tuned installation techniques they have accrued over the years. Solar panels have been around for many years, so the industry has evolved quite a bit!

Beyond the financial benefits, what else can solar panels bring to your business? Among the most substantial benefits is the access to clean energy. Many businesses today adopt eco-friendlier processes to make a positive change on the environment. Thankfully, solar panels provide a way to help both the environment and businesses simultaneously. For example, installing solar batteries means you always have access to backup solar power when necessary. Likewise, even when the system is functioning as normal, you can experience green energy that will power your daily needs admirably.

Plus, solar panels don’t need to rely on sunny days to function properly. Even during the wintertime or any cold, cloudy day throughout the year, high-quality solar panels will still gather the sun’s rays and convert them into power. Of course, levels of efficiency will vary across seasons, though every state’s seasonal experiences differ. Simply put, solar panels can accommodate a versatile range of requirements.

One important reminder is that the details regarding the ITC and other incentives aren’t tax advice. Instead, we merely want to shed light on possible avenues you can take to earn solar panel rebates and incentives for your business. At Go Solar Power, we’re experts in solar technology, but always consult your tax expert before making any decisions, like pursuing the ITC.